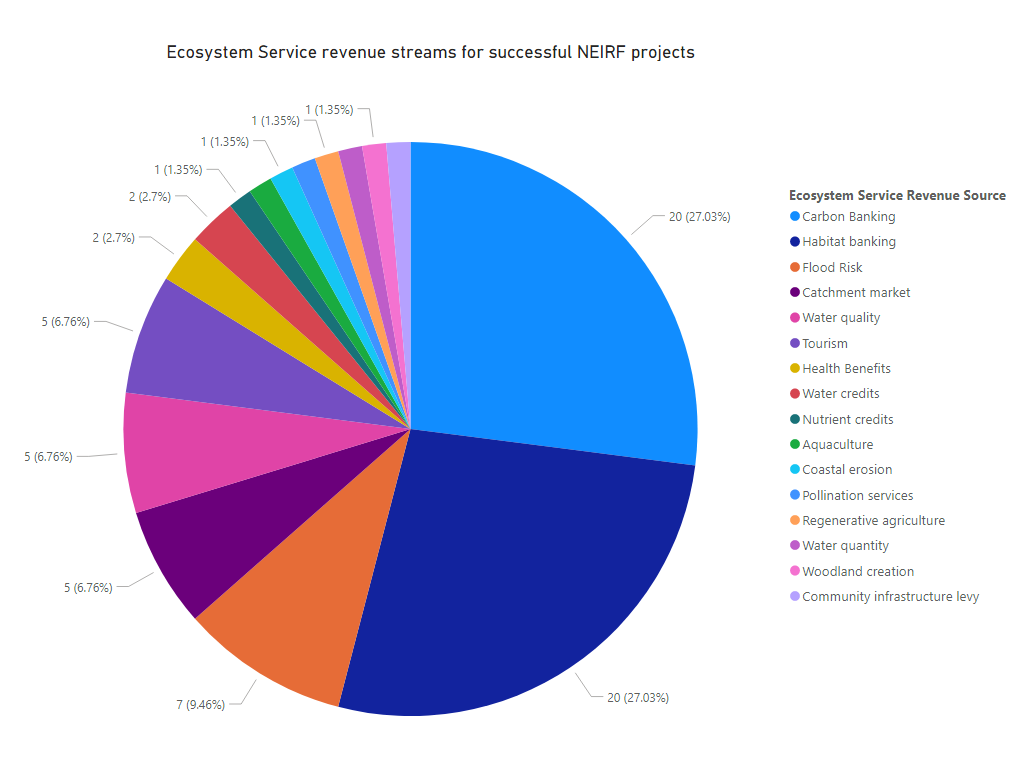

Allocation of NEIRF highlights sixteen ecosystem services for revenue generation

As part of the Natural Environment Investment Readiness Fund (NEIRF) from DEFRA, the Environment Agency and Natural England, 27 projects have now been awarded funding in round one to help drive private investment in nature and help tackle climate change. The selection of projects highlights the variety in ecosystem services that are being explored for generating investment from the private sector.

Carbon banking and habitat banking are the most commonly named ecosystem services for revenue generation, with some projects naming more than one ecosystem service to be explored. There were a number of catchment related markets noted for exploration, including catchment markets as an aggregated product, water quality, flood risk, water quantity and water credits.

In terms of the financial support to be provided by the NEIRF, carbon banking and habitat banking have received the highest amount of funding, with £1.868 million and £1.865 million respectively.

21/07 Update - Following additional analysis, we can now share insights into the geographical distribution of NEIRF funding by ecosystem service. A number of successful applications list multiple ecosystem services so those projects have been marked as such. By interacting with the map you can see the funding allocation for each successful project. Only projects with a geographical presence have been mapped, with those projects in multiple locations marked separately.

For more information and the list of successful projects, please visit the gov.uk page here. Or hear about some of the projects in this video from the Environment Agency on Twitter. The next round of applications is due to take place in Autumn/ Winter 2021.

Accelar is actively supporting a range of clients to get their nature recovery and climate change green finance projects off the ground - see here for further information or get in touch.